Tweezers_Metabacktest.ex4 Tweezers_Metabacktest.mq4 Tweezer-EURUSD-USDJPY-Setting.set Tweezer-USDCAD-H4-Setting.set

Result-EURUSD-H1.zip Result-USDJPY-H1.zip Result-USDCAD-H4.zip

Home / Articles / #8

Tweezer Tops & Tweezer Bottoms EA – Precision Reversals with Smart Money Management

Hadi

2025-09-13 21:46:41

At MetaBacktest, we’re always striving to combine simplicity with sophistication in trading tools. Our Tweezer Tops & Tweezer Bottoms EA is a perfect example: a strategy that identifies high-probability candlestick reversal patterns and executes trades with professional-grade money management, risk control, and filtering mechanisms.

How the EA Works

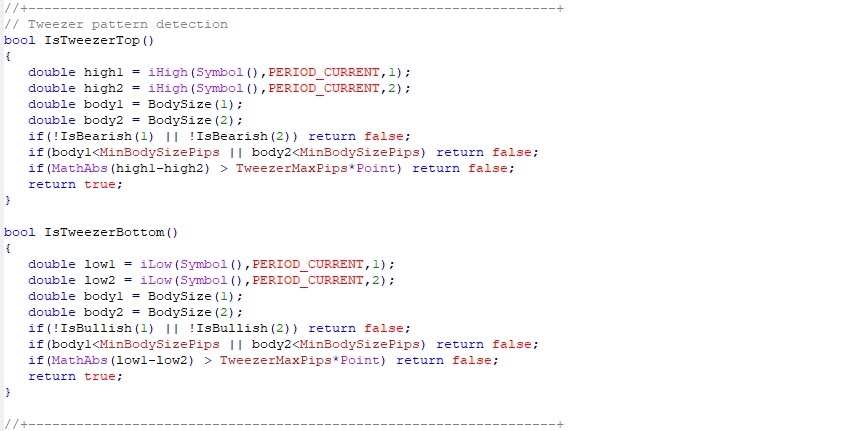

The core concept of the EA is based on Tweezer Top and Tweezer Bottom candlestick patterns, which are widely recognized by technical analysts as potential reversal signals:

- Tweezer Tops occur at the end of an uptrend. They form when two consecutive bearish candles have nearly identical highs, signaling that buyers are losing momentum and sellers are taking control.

- Tweezer Bottoms appear at the end of a downtrend. Two consecutive bullish candles with nearly identical lows indicate that sellers are exhausted, and buyers are stepping in.

The EA detects these patterns automatically on your chosen timeframe and executes trades in the correct direction:

- Buy when a Tweezer Bottom forms.

- Sell when a Tweezer Top forms.

Smart Money Management

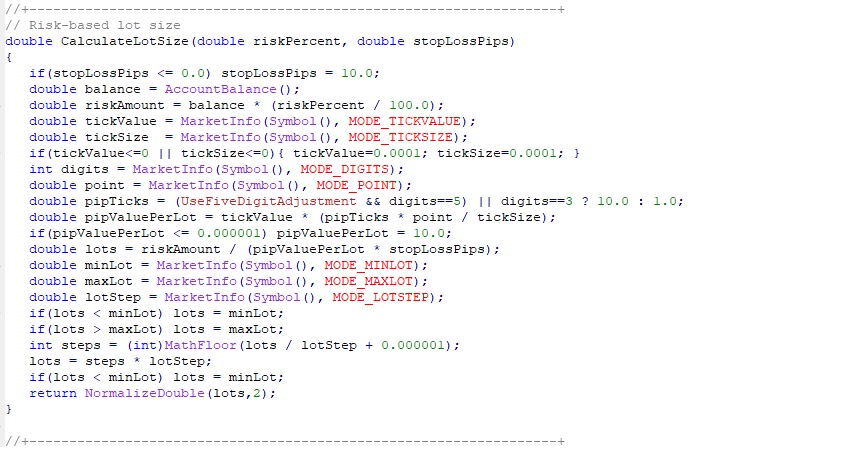

What sets this EA apart is its advanced risk management system, designed to protect your account while maximizing opportunities:

- Risk-Percentage-Based Lot Sizing

- The EA calculates your lot size based on a percentage of your account balance, ensuring that each trade risks a fixed portion of your capital.

- ATR-Based Stop Loss

- Stop losses are dynamically calculated using the Average True Range (ATR) of recent bars, adapting to market volatility.

- Optional fixed stop loss is also supported for traders who prefer a constant risk per trade.

- Optional Take Profit

- Set a fixed take profit in pips, or let the EA manage exits dynamically based on market behavior.

- Max Trades Control

- Limit the number of total open trades and per-direction trades to avoid overexposure.

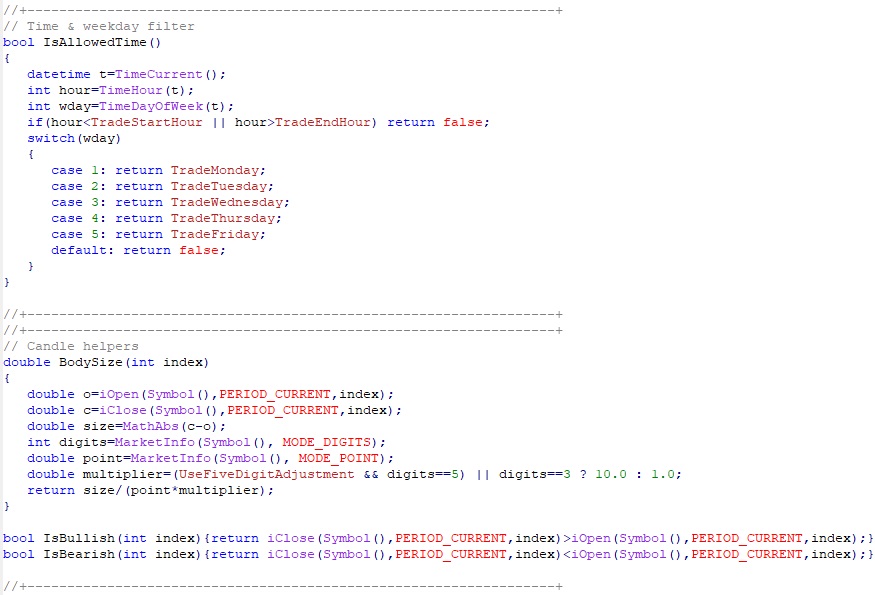

Trading Filters for Safety

To ensure quality trades, the EA incorporates multiple safeguards:

Here’s how it works:

- Time Filter : Trade only during your preferred hours.

- Weekday Filter: Avoid trading on low-liquidity days if desired.

- Spread Check: Avoid trading when spreads exceed your defined maximum.

- Minimum Candle Body Size: Only trade patterns with meaningful candle sizes to reduce noise.

Broker Compatibility and Precision

- Fully compatible with 3-, 4-, and 5-digit brokers.

- Optional bar-close evaluation ensures patterns are confirmed before placing trades, reducing false signals.

Why This EA Stands Out

- Pattern Accuracy:

- Professional Money Management: Combines risk-percentage lot sizing with ATR-based stop losses for dynamic protection.

- Safety Filters: Time, weekday, spread, and candle size filters reduce exposure to risky conditions.

- User-Friendly: Modular and adjustable inputs let both beginners and advanced traders optimize their strategy.

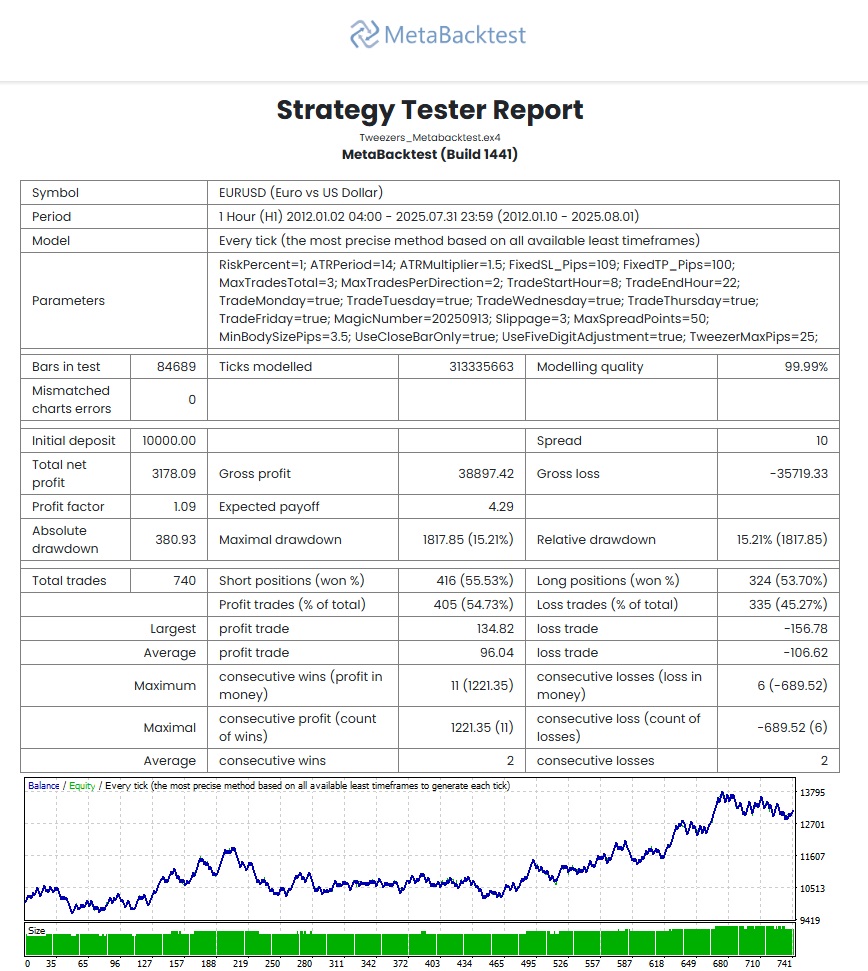

Backtest Results by MetaBacktest

We ran multiple backtests of the MQL4 Expert Advisor using MetaBacktest to ensure fair and transparent results.

Test Parameters:

- Instrument : EURUSD

- Timeframe : H1

- Period : Jan 2012 – Aug 2025

- Lot Size : Risk-Based Floating Lot Size

- Stop Loss / Take Profit : 109 pips fixed SL/ 100 pips fixed TP

- Maximum Allowed Trades : 3

Process time: 0:01:12.312

Key Results:

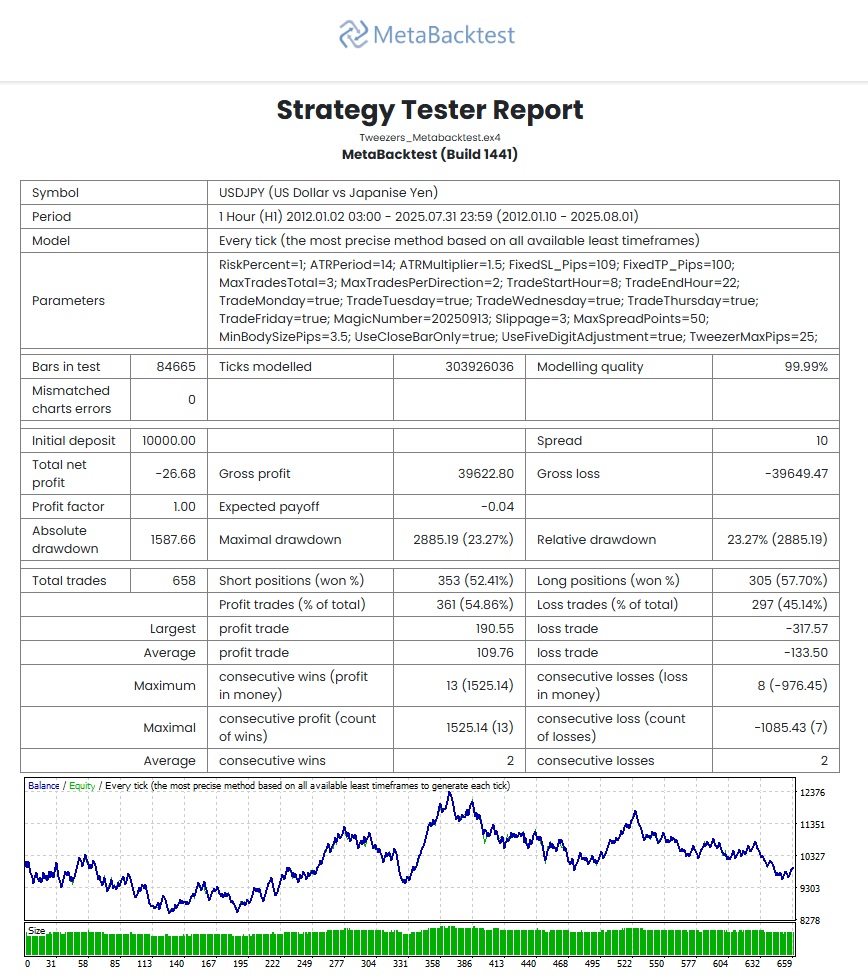

Test Parameters:

- Instrument : USDJPY

- Timeframe : H1

- Period : Jan 2012 – Aug 2025

- Lot Size : Risk-Based Floating Lot Size

- Stop Loss / Take Profit : 109 pips fixed SL/ 100 pips fixed TP

- Maximum Allowed Trades : 3

Process time: 0:00:58.922

Key Results:

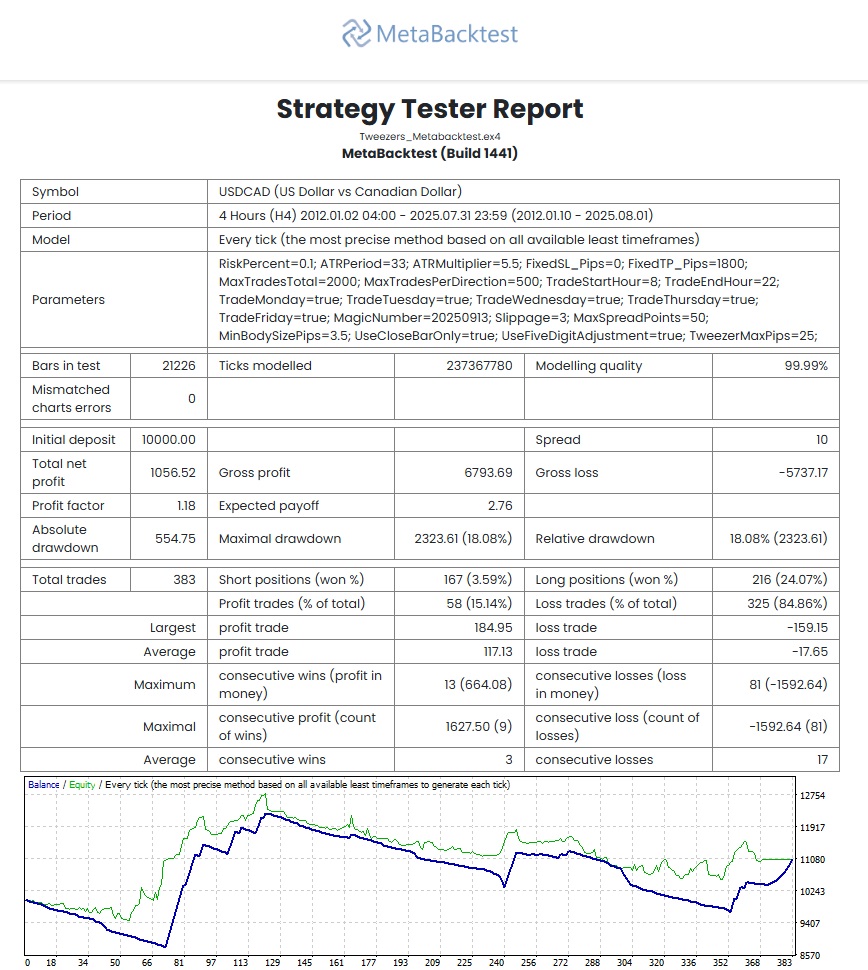

Test Parameters:

- Instrument : USDCAD

- Timeframe : M15

- Period : Jan 2012 – Aug 2025

- Lot Size : Fixed 0.01 Lot Size

- Stop Loss / Take Profit : ATR-Based Stop Loss / 1800 pips fixed TP

- ATR Period for SL Size : 33

- ATR * multiplier = SL in pips : 5.5

- Maximum Allowed Trades : 2000

- Maximum Buys or Sells : 500

Process time: 0:02:38.375

Key Results:

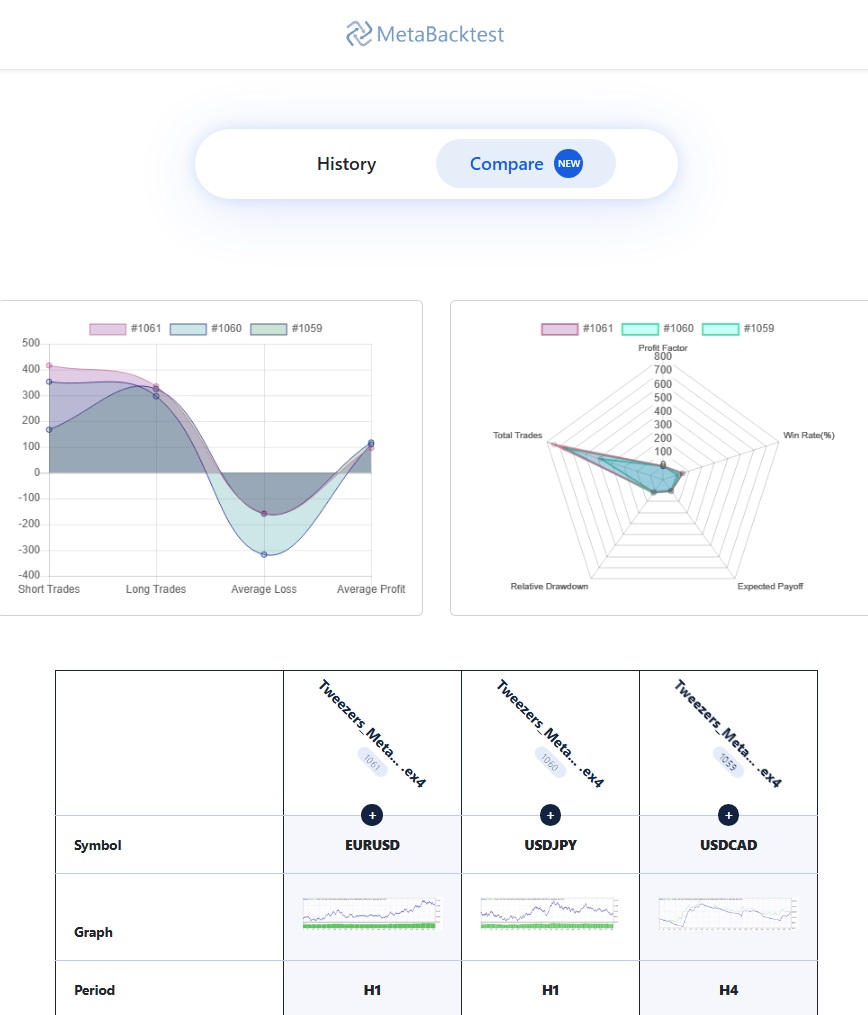

Comparison by MetaBacktest:

Final Thoughts

The Tweezer Tops & Tweezer Bottoms EA is not just a pattern detector—it’s a complete trading system that combines technical analysis, adaptive risk management, and robust trading filters. Whether you are a disciplined swing trader or a trend-reversal strategist, this EA offers a seamless way to harness candlestick reversals with precision and confidence.

At MetaBacktest, we believe in providing tools that are both intelligent and practical, and the Tweezer EA is a testament to that philosophy.

By automating both detection and execution, traders can remove emotional decision-making and test these setups objectively with the MetaBacktest.

Before going live, always run thorough backtests to adapt the EA to your pair, timeframe, and risk tolerance.

Piercing Pattern & Dark Cloud Cover EA - Candlestick Trading in Forex

2025-09-16 09:11:14

Adaptive Randomized Bernoulli Cascade System

2025-10-21 09:12:41

Tweezer Tops & Tweezer Bottoms EA – Precision Reversals with Smart Money Management

2025-09-13 21:46:41

Comments

13 comments

U

0 characters

Be respectful and constructive

Big respect to MetaBacktest team for putting out free education with working code. Most sites charge for this stuff.

I like how you combined a classic candlestick setup with smart money management. Too many traders ignore risk.

Exactly. You can have the best entry but without MM you’ll still blow up.

How does the EA handle consecutive Tweezer signals in the same direction? Does it open multiple trades or just one?

It respects trade count limits.

I tested this EA on EUR/USD last night — results were surprisingly consistent.

Nice! Which timeframe did you run it on?

H1. But I’ll try H4 too since the patterns are cleaner there.

Love the part about RSI-based stop loss and take profit. That’s next-level compared to fixed pips.

Yes! Fixed SL/TP often kill strategies during volatility. RSI adapts to conditions.