MACD-Zero-Line-EA-MetaBacktest.ex4 MACD-Zero-Line-EA-MetaBacktest.mq4

Result-EURUSD-H1.zip Result-EURUSD-M1.zip Result-USDJPY-H1.zip

Home / Articles / #6

Does the MACD Zero Line Strategy Work? Backtest Results Revealed

Hadi

2025-09-05 15:41:11

At MetaBacktest, we love testing simple trading strategies that are easy to understand, quick to implement, and suitable for both beginners and advanced traders. In this article, we’ll take a closer look at the MACD Zero Line Strategy, build an Expert Advisor (EA) in MQL4, and share backtest results so you can see how it performs in real market conditions.

The MACD (Moving Average Convergence Divergence) indicator is one of the most popular momentum oscillators in trading. While many traders focus on MACD crossovers or divergence setups, there’s another very effective approach: using the zero line as a momentum filter.

Here are the simple rules:

- Buy Signal: When the MACD line crosses above zero (bullish momentum starts).

- Sell Signal: When the MACD line crosses below zero (bearish momentum starts).

- Stop Loss: Fixed 50 pips (or adjusted to swing highs/lows).

- Take Profit: Fixed 50 pips.

- Trailing Stop: Activated as long as MACD stays on the right side of zero.

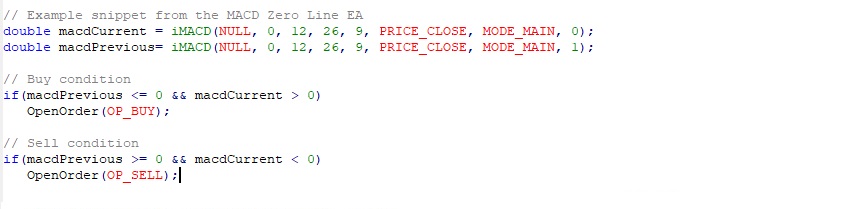

The Expert Advisor (MQL4 Code)

We coded the strategy into a simple MetaTrader 4 Expert Advisor. The EA automatically:

- Detects MACD zero-line crossovers.

- Opens Buy/Sell trades accordingly.

- Applies a fixed stop loss and take profit.

- Moves the stop loss dynamically (trailing stop) if MACD keeps supporting the trade.

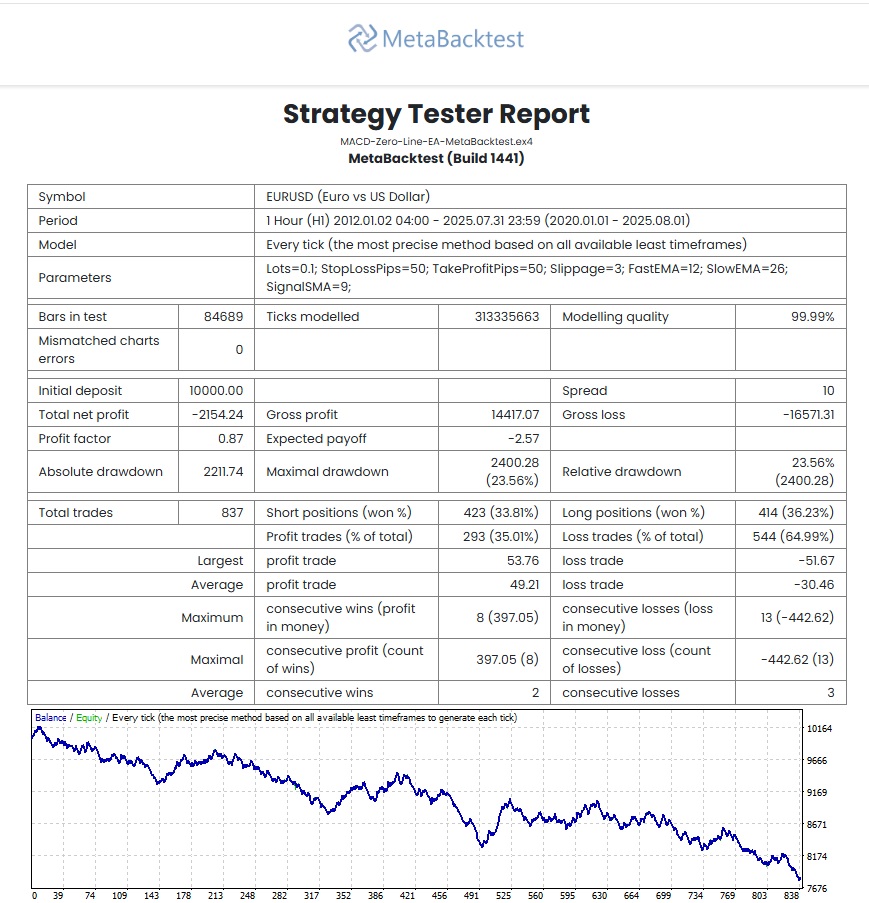

Backtest Results

We ran multiple backtests of the MACD Zero Line EA using MetaBacktest to ensure fair and transparent results.

Test Parameters:

- Instrument : EURUSD

- Timeframe : H1

- Period : Jan 2020 – Aug 2025

- Lot Size : 0.10

- Stop Loss / Take Profit : 50 pips each

- Trailing Stop : Enabled

Key Results:

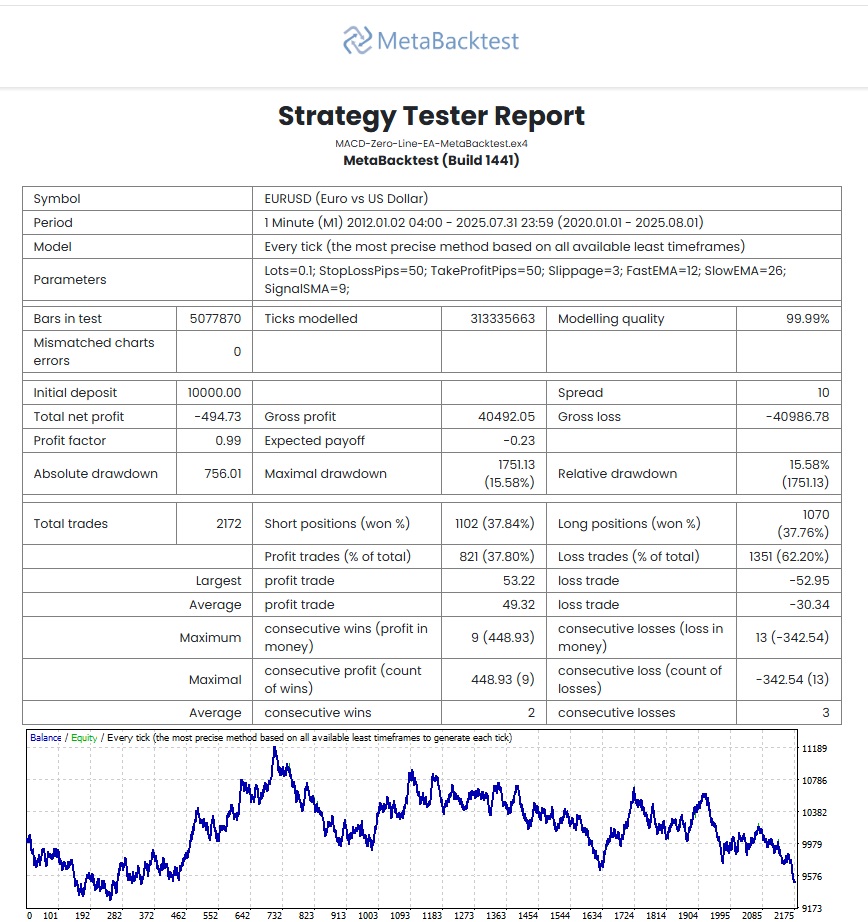

Test Parameters:

- Instrument : EURUSD

- Timeframe : M1

- Period : Jan 2020 – Aug 2025

- Lot Size : 0.10

- Stop Loss / Take Profit : 50 pips each

- Trailing Stop : Enabled

Key Results:

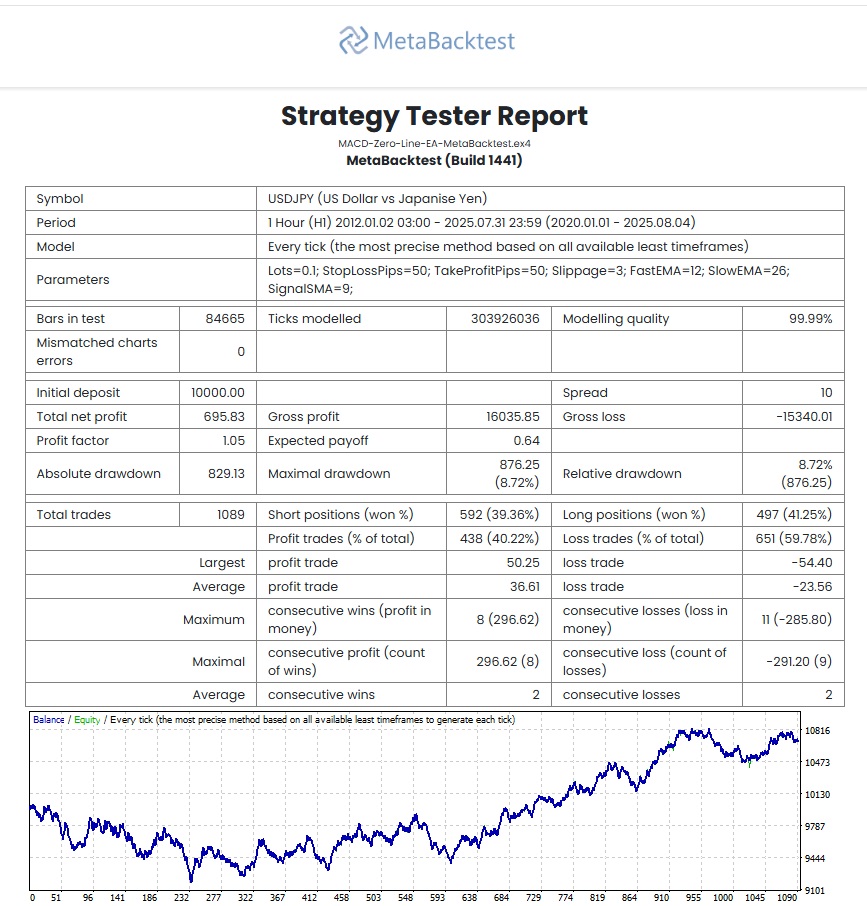

Test Parameters:

- Instrument : USDJPY

- Timeframe : H1

- Period : Jan 2020 – Aug 2025

- Lot Size : 0.10

- Stop Loss / Take Profit : 50 pips each

- Trailing Stop : Enabled

Key Results:

What We Learned:

- The MACD Zero Line Strategy is simple, yet it proves to be consistently powerful—especially when applied to momentum-driven pairs like USDJPY, where its recurring signals often align with strong market moves.

- Avoids overtrading since signals only occur when momentum flips.

- Drawdowns are moderate, making it suitable for small accounts with proper risk management.

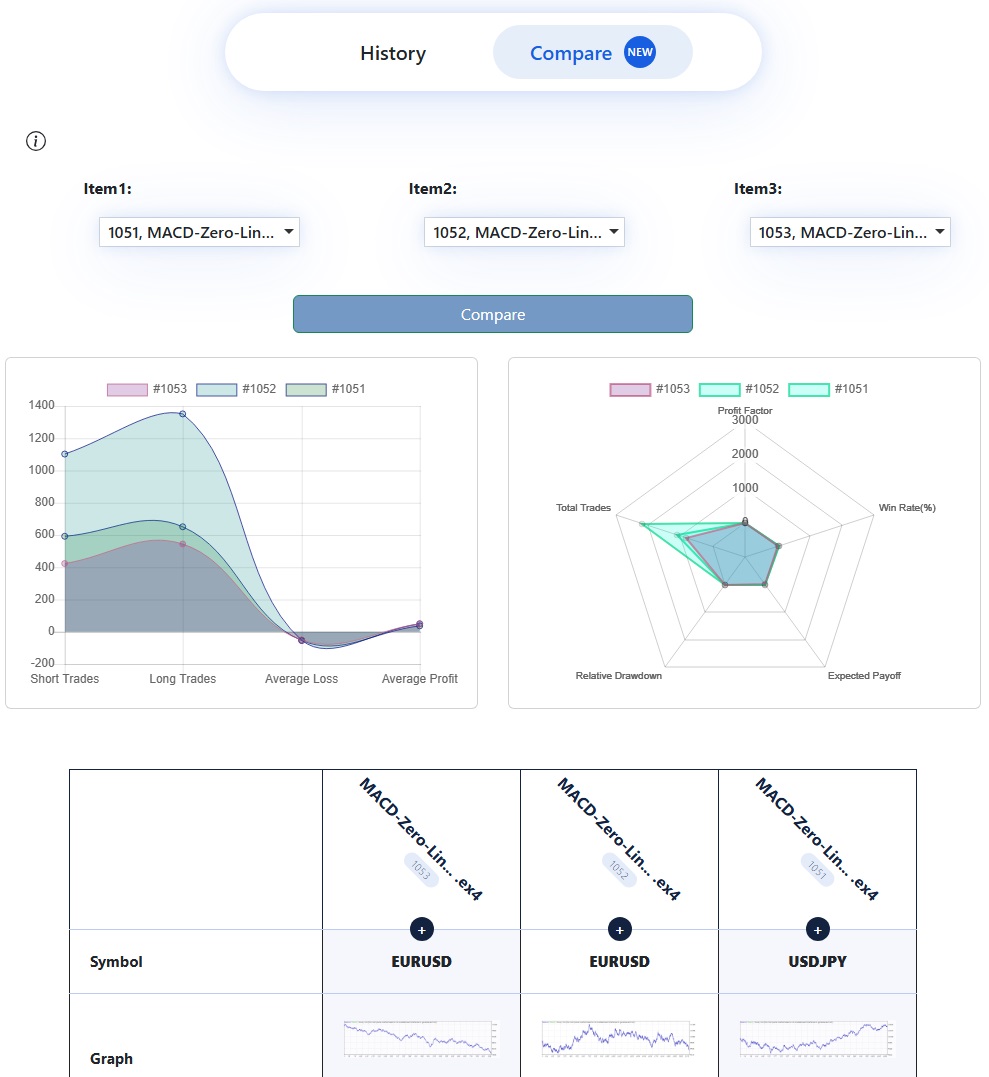

Comparison by MetaBacktest:

Try It Yourself with MetaBacktest

The best way to learn any strategy is by testing it yourself. With MetaBacktest, you can upload your EA, test across different pairs, and optimize parameters instantly.

You can use your free trial to start backtesting your strategies right away—hassle-free!

Final Verdict:

The MACD Zero Line Strategy is a great starting point for traders who want a rules-based system with clear entries and exits. While it’s not a “holy grail,” it provides a solid framework for capturing momentum-driven moves in the forex market.

You can use your free trial to start backtesting your strategies right away—hassle-free!

Backtesting 'EMA-CrossOver' strategy with a custom setting file

2024-08-29 09:12:12

How to Build a Probability-Aware EMA Trading Strategy Using the Binomial Distribution in MQL4 with MetaBacktest

2025-10-15 08:42:39

Does the MACD Zero Line Strategy Work? Backtest Results Revealed

2025-09-05 15:41:11

I love that you actually ran proper backtests instead of just saying “it works.” Numbers talk louder than opinions.

I’m curious. did you notice if the zero-line entries work better with higher timeframes like D1 instead of H1?

Daily charts definitely filter out noise. H1 is too choppy for MACD zero-line.

The drawdowns seem a bit high for my taste lol

does the strategy perform better on trending pairs only?